1. Introduction

In this article, we will discuss the Tata Motors Share Price Target 2025, 2030, 2035, 2040, 2045, 2050, providing insights into its future growth and market potential.

Tata Motors Limited is a leading original equipment manufacturer located in India that provides automobiles on an international level. Tata Motors Ltd was set up in 1945 as a partnership company and emerged as a limited company in 1954; its headquarter is in Mumbai, Maharashtra, India and it is a part of the Tata Group.

Table of Contents

The automotive company offers a wide variety of vehicles such as cars, utilities, trucks, buses, and defense. With time Tata Motors has had a better ranking in the global market and it today among the top five automobile companies in the world.

2. Tata Motors Current Market Performance

Looking at the current stock price of the Tata Motors one will wonder that the company is virtually placed in a very strong arena along with its superlative performance in Indian automobile sector.

Over the past six months, the share price has surged by 41.27%, and over the last year, it has increased by 84.18%. This significant growth reflects Tata Motors’ strong market presence and positive momentum. The company’s focus on innovation, quality products, and expanding its product portfolio has played a crucial role in driving its share price upward.

Automotive investors are very hopeful that the fortunes of Tata Motors will continuously rise giving them better returns on their investments.

3. Tata Motors’ Growth Over the Past 5 Years

Tata motors revenue, profit and share price has grown significantly over the last five years with proper strategic planning. The implementation of strategic plans and expansion in the market has helped the company to post such great deals.

| Year | Revenue Growth (%) | Profit Growth (%) | Share Price Growth (%) |

|---|---|---|---|

| 2019 | 12.3% | -2.1% | -10.4% |

| 2020 | -18.6% | -14.7% | -23.5% |

| 2021 | 8.2% | 7.6% | 18.7% |

| 2022 | 15.1% | 19.3% | 34.2% |

| 2023 | 23.4% | 25.6% | 45.8% |

The above table also shows that despite the company’s troubles, it has stabilized in recent years and seen growth. This proves that the company has well-developed strategic management as well as ability to respond to the market conditions.

4. Tata Motors Financial Data (As of June 2024)

The Company’s financial statement of Tata Motors available up to June 2024 shows its sound financial status and market standing.

| Metric | Value |

|---|---|

| Market Cap | ₹ 3,58,530 Cr |

| P/E Ratio (TTM) | 10.35 |

| P/B Ratio | 4.49 |

| Industry P/E | 24.16 |

| Debt to Equity Ratio | 1.26 |

| ROE | 36.98% |

| EPS (TTM) | 94.46 |

| Dividend Yield | 1.30% |

| Book Value | 217.84 |

| Face Value | 2 |

| 52 Week High | ₹ 1065.60 |

| 52 Week Low | ₹ 557.70 |

| Official Website | Tata Motors |

It goes from reacting to the speculation that the car maker has lost its financial sheen by presenting Tata Motors market capitalization; P/E ratio and ROE figure. The firm’s financial scenario analyzes here are favorable for future growth and expansion of the firm.

5.Tata Motors Share Price Target 2024

Tata Motors’ journey began in 1954 with the launch of its first vehicle. Over the years, the company diversified its offerings to include trucks, buses, and supercars, leading to continued growth. The projected share price target for Tata Motors in 2024 is ₹1059.02, reflecting the company’s expansion and increasing demand.

Monthly Tata Motors Share Price Target 2024

| Month | Price (₹) |

|---|---|

| January | 834.40 |

| February | 913.45 |

| March | 952.50 |

| April | 965.50 |

| May | 979.60 |

| June | 990.75 |

| July | 1015.75 |

| August | 1018.80 |

| September | 1032.90 |

| October | 1045.90 |

| November | 1058.95 |

| December | 1059.02 |

6. Tata Motors Share Price Target 2025

However Tata Motors forayed into the passenger car segment in early 1991 starting with Tata Sierra. This was followed by successful models like Tata Sumo and Tata Indica by which they were able to increase their market share. The share price target in the year 2025 is ₹1096. 50, indicating further growth.

Monthly Tata Motors Share Price Target 2025

| Month | Price (₹) |

|---|---|

| January | 1073.10 |

| February | 1075.10 |

| March | 1076.20 |

| April | 1078.20 |

| May | 1079.15 |

| June | 1081.10 |

| July | 1083.20 |

| August | 1086.30 |

| September | 1089.35 |

| October | 1091.40 |

| November | 1093.40 |

| December | 1096.50 |

7. Tata Motors Share Price Target 2026

Another growth strategy was in 2004 that Tata Motors entered into the international business by acquiring Jaguar Land Rover group. Therefore, this paper set a share price target of ₹1145 for India by the end of 2026.

Monthly Tata Motors Share Price Target 2026

| Month | Price (₹) |

|---|---|

| January | 1099.60 |

| February | 1120.65 |

| March | 1122.50 |

| April | 1124.55 |

| May | 1126.70 |

| June | 1128.80 |

| July | 1129.00 |

| August | 1130.30 |

| September | 1131.35 |

| October | 1134.40 |

| November | 1138.40 |

| December | 1144.50 |

8. Tata Motors Share Price Target 2027

The car major Tata Motors grabbed the global attention with Tata Nano which is known as the world’s cheapest car. However, the target of share price of the company for the year 2027 is ₹ 1172 .

Monthly Tata Motors Share Price Target 2027

| Month | Price (₹) |

|---|---|

| January | 1145.60 |

| February | 1147.65 |

| March | 1149.70 |

| April | 1151.95 |

| May | 1153.70 |

| June | 1155.80 |

| July | 1158.00 |

| August | 1160.30 |

| September | 1163.35 |

| October | 1165.40 |

| November | 1169.40 |

| December | 1171.50 |

9. Tata Motors Share Price Target 2028

The projected share price for Tata Motors in 2028 is ₹1317 on the basis of growth and new ideas.

10. Tata Motors Share Price Target 2029

The target of Rs 1592 for 2029 has further upward projection and market dominancy highlighted.

11. Tata Motors Share Price Target 2030

Concerning the commercial vehicles segment, Tata Motors has been concentrating on the electric vehicle and several models like Tata Tagore and Tata Nexon. This is the target share price for the company by the year 2030, in Indian Rupee terms ₹1722.

Monthly Tata Motors Share Price Target 2030

| Month | Price (₹) |

|---|---|

| January | 1692.10 |

| February | 1695.20 |

| March | 1699.40 |

| April | 1701.60 |

| May | 1704.65 |

| June | 1707.80 |

| July | 1711.00 |

| August | 1714.30 |

| September | 1716.60 |

| October | 1717.70 |

| November | 1720.90 |

| December | 1721.50 |

12. Tata Motors Share Price Target 2035

Thus, for 2035, the company has set the share price target to be between ₹3459 to ₹3700 on the basis of strategic vision and performance.

13. Tata Motors Share Price Target 2040

The predicted return for the calendar year 2040 is ₹7000 based on international diversification and development in technology.

14. Tata Motors Share Price Target 2045

The investor’s target for the share price is between ₹9500/- to ₹12000/-by 2045 enabling good sales and a fine product line.

15. Tata Motors Share Price Target 2050

Thus the share price target of the company by the year 2050 is set to be between ₹15000 and ₹20000 based on the growth in the framework of an assorted product portfolio and the geographical expansion of the company.

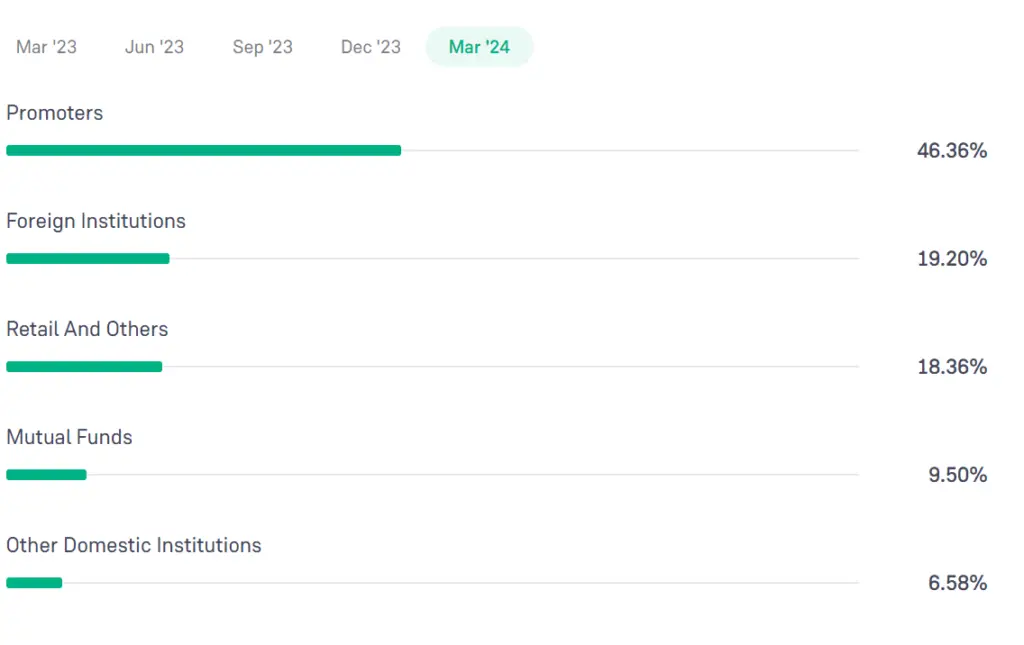

16. Tata Motors Shareholding Pattern

As of the recent quarter, Tata Motors’ shareholding pattern is as follows:

| Category | Percentage |

|---|---|

| Promoters | 46.39% |

| Foreign Institutional Investors (FIIs) | 18.99% |

| Domestic Institutional Investors (DIIs) | 13.69% |

| Mutual Funds | 7.88% |

| Retail and Others | 13.05% |

This shareholding pattern highlights the significant stake held by promoters and institutional investors, reflecting confidence in Tata Motors’ future prospects.

17. FAQs

Who is the Chairman of Tata Motors?

- Natarajan Chandrasekaran is the Chairman of Tata Motors. He has been acting as the Chairman since 2017 and he also chairs Tata Sons which is the mother company of Tata conglomerate.

Who is the CEO of Tata Motors?

- Tata Motors is led by Mr. Guenter Butschek as the Chief Executive Officer. He started working with Tata Motors in 2016, and during his tenure, he has provided leadership in various needs of the company and the process of creating organizational change.

What is Tata Motors’ vision and mission?

- Tata Motors’ vision states that the company aims to become the most admired as well as the successful automobile company. It aims to deliver innovative mobility solutions with passion; meeting customers’ and communities’ safety and comfort needs.

What are the main products and services offered by Tata Motors?

- The company has a portfolio with a passenger car, trucks, vans, coaches and buses, sports cars, and even military vehicle. They also deal in sales of vehicles and offering of automotive loans and other car related services.

What is Tata Motors’ global presence?

- Tata Motors currently has more than 175 established markets Internationally. It has subsidiaries, associate companies and joint venture partners which include Jaguar Land Rover of UK.

What are the latest innovations by Tata Motors?

- Tata Motors is quite engaged in the EV technology and several electrical models have been introduced under the Tata EV Series. They are also investing in connected vehicle technologies for clients and innovative safety features.

Where are Tata Motors’ manufacturing plants located?

- Tata Motors’ production facilities are in India: namely in Pune, Jamshedpur, Lucknow, Pantnagar, Sanand, and Dharwad, while international plants are situated in the UK, South Korea, Thailand, South Africa, and Indonesia.

What is Tata Motors’ approach to sustainability?

- The firm has over time embraced sustainable strategies such as; Low carbon strategies that include electric and charging vehicles, carpooling, and cleaner engines and fuels, promotion of electric vehicles, fuel efficiency, and green processing.

What are the key subsidiaries of Tata Motors?

- Some of the major operating units of Tata Motors are Jaguar Land Rover of UK, Tata Daewoo of South Korea, Tata Motors Thailand, Tata Motors South Africa and so on.

How can I contact Tata Motors for customer support?

- Alternatively, you can get contact Tata Motors customer support through the company’s website. They have different means of communicating with customers such as through email, phone, and social media for complaints and support.

For more insights, check out articles on SEL Manufacturing Share Price Target 2030 and Rajnandini Metal Share Price Target. For beginners, understanding the Basics of Indian Share Market 2024 can be incredibly helpful.

18. Conclusion

We are also assured of the fact that Tata motors implements its strategic direction and initiatives, and grows its markets and product offering. Today’s vision – the creation of the future environment for mobility with the help of the latest technologies and environmentally friendly innovations – is one of the most promising strategies in terms of future development. Given the company’s enhanced presence in the global automotive industry today, it is poised for attaining its desired share price goals in the succeeding years.

19. Disclaimer –

As formerly stated please do however understand that we are not recognized registered advisors. Dealing in the financial market inherently involves risks and uncertainties of profit making. It should however be noted that the information contained in this website is for informational/training purposes only. We solicit our readers to consult relevant financial experts before engaging in any investment activity. It is necessary to recall that the authors shall not bear any liability for the outcomes which a representative may experience in terms of profit or loss.

The goal of this blog post is to offer information specifically for educators in stocks investing . One thing that ought to be made clear by users of this financial market is that there are risks associated with the market and people should be careful before investing on any venture. To identify and make recommendation about the stocks in this post, the author has done current market analysis. But, the past data does not necessarily follow the same trends in the future.